Debtor funding is getting continual appeal to fund the expanding companies. It enables you to pay for the business expenses utilizing the slow-paying billings. It gives a versatile credit line which depends on impressive invoices and might be really helpful for both small and also huge organisations.

Let us try to know even more about Debtor financing, its working, and advantages in this article.

What is Debtor Financing?

Borrower Money is a non-specific term alluding to products that save an organization by financing its billings. It is likewise called Cashflow finance. The two a lot of basic kinds of Borrower financing are Billing Factoring and also Invoice Discounting. Both of these take on the exact same issue as well as provide same advantages. Be that as it may, they work in a various method as well as deal diverse functions.

Just How Borrower Money Functions?

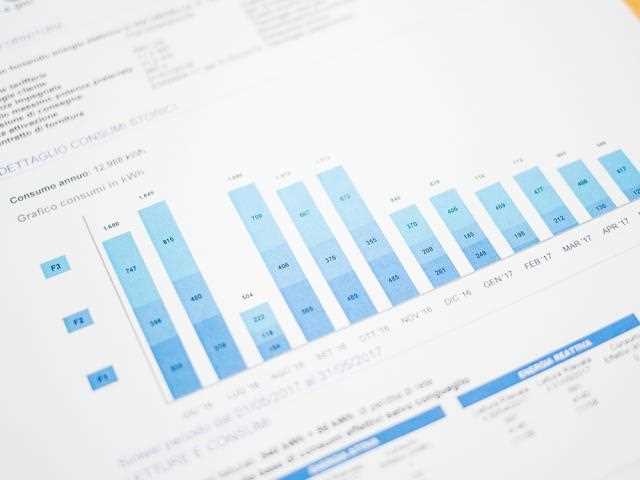

As a company conveys services to the consumers, the solicitations invoices elevated are sent out to the sponsor. The sponsor after that examines the billings as well as developments approximately 90 percent of the overdue receipt esteem inside 1 day. The business can then get to the available assets as needed. The remaining rate of the invoice is paid to business once the customer receipt is completely paid, less a little cost.

The business can hold control of the bookkeeping and build-ups abilities, or they can select the loan provider to control this capability as a component of a full management plan. A lot of Borrower Finance financiers provide on-line accessibility to reporting, permitting business to track installation receipts.

There are two sorts of Borrower Money:

Divulged:

In this type the debtor or client is informed on invoices that funds are directly payable to the financier. This is called as Billing Factoring.

Confidential:

In this kind the borrower or customer is not aware of the truth that the funding being provided. This is known as Invoice Discounting.

Billing Factoring:

Invoice Factoring is a disclosed financing center planned to enhance a company’s Cashflow by transforming invoices into working funding. It offers quick access to up to 90 percent of the evaluation of verified Invoices. The staying equalization, less charges, is made obtainable to business when installation is received from their consumer. This center is an option center. The local business which have cash flow issues utilizes Billing Factoring.

Invoice Factoring is usually provided as a complete management arrangement, with obligation gathering, deals record company and reporting gave to companies who don’t have their own credit history administration assets.

The lending institution’s experienced responsibility buildup administrations can assist with gathering commitment expeditiously and also proficiently. However, with a figuring understanding set up it is still workable for a company to maintain dealing with their own commitment gathering if longed for. For more related articles for the working procedure of debtor finance continue reading this.

Invoice Discounting:

The identified financing center meant to enhance a company’s capital by giving financing against the organization’s impressive receivables is known as Invoice Discounting. It is used by the huge firms which have a proper credit scores and also collection procedure.

It provides snappy accessibility to approximately 90 percent of the estimate of the verified Invoices. The remaining equilibrium, less charges, is made available to business when installment is received from their customer.

Billing Discounting is usually used by accumulated organizations that have an internal build-ups or credit administration division These companies handle their own certain build-ups and needn’t trouble with the financier to gather billings for them.

Organizations making use of Invoice Discounting might not need all invoices moneyed, and might just use it as a kind of overdraft account office for crucial supply gets or salaries. Billing Discounting permits a service as for feasible on the amounts attracted down to control interest costs.

Typically, the length of the document is all over supervised, simply business and the sponsor find out about the Invoice Discounting center.

Benefits of Borrower Finance:

Enhanced Cash Flow: Typically the sales are turned into funds within 24-hour.

Power to Discuss: It offers the flexibility to the businesses to negotiate far better with the providers.

Flexibility: The Borrower Finance facility restrictions grow in-line with sales.

Payment Price Cuts Removal: It gets rid of the requirement to use repayment price cuts to the customers. Debtor Money cost is normally less than the punctual payment price cuts.

Service Equity Retention: It allows you to gain access to funds for company development, with Borrower Financing as opposed to marketing organisation equity.

Billing Factoring Benefits:

It assists in a much better credit administration.

It assists to assist business having a strong or weak annual report position.

It aids to assist businesses which might stop working to qualify for conventional banking items.

Invoice Discounting Advantages:

It matches to business which have traded positively and also have a positive internet assets placement.

It also fits to business that are trading with no lender issues.